featured item

Antiques Magazine

Why art prints are a big deal for antique & vintage collectors

If, like us, you love the thrill of finding something with history, character, and a story behind it, you may want to start paying attention to prints – if you haven’t already. From engravings and etchings, to lithographs, and silkscreens, they’re seeing a surge in popularity amongst collectors.

That makes perfect sense: prints are affordable, easy to live with, rich in artistic heritage, and they open up collecting opportunities that might usually be out of reach to the average joe. And right now, the market for them is booming.

If you normally spend your time rummaging through antique shops, leafing through auction catalogues, or hunting down vintage treasures, here's why prints might soon be your new favourite category.

Antiques & Vintage: what might be most collectable in 2026?

Expert predictions for the next wave of collectibles...

Nobody can see into the future, but here at Antiques.co.uk we like to use our professional nous – and data insights – to make our very best expert guesses.

Each January, we ask the question that is on the antiques world’s lips, which is: ‘what antiques and vintage pieces might be most collectable in 2026?’

So if, like us, you’re curious about which antiques are set to be the most collectable this year, here’s a guide to help you get started.

Cha-ching! How to sell an antique, declutter your home and make some cash

It's the new year, a great time to declutter your home - and make some welcome cash by selling items over 40-50 years old that you might have lying around in the attic or garage.

Whether you're brand new to selling antiques, or haven't sold with us before, read our Frequently Asked Questions and 'how to' guide to get your antiques and vintage pieces in front of thousands of buyers from around the world!

13 Fabulous Last Minute Christmas Gifts For Under £100

Within the space of a couple of weeks in December, Christmas shoppers are faced with a gift timeline that’s very quickly gone from ‘plenty of time!’ to ‘there’s no time at all!!’

As the days until Christmas slip by in their well-worn fashion, it’s time to spring into action and start seriously considering what you’re getting everyone this year.

But it might be that you’re shopping on a budget, and if that’s the case, you’ll need some inspiration for items that are genuinely affordable – and on the smaller size, to avoid any sizeable shipping costs.

So if you’re in a hurry, and are a little stuck for ideas, we’ve curated 13 of the most fabulous – and affordable – last minute Christmas gift ideas – each for under £100.

11 Cool Christmas Gifts for Everyone: The Magic of Antique & Vintage Finds

When it comes to buying Christmas gifts, finding something that’s actually unique can feel like searching for a needle in a haystack.

In a world overflowing with mass-produced gadgets and gift cards, antique and vintage items stand out as thoughtful, memorable, and – dare we say – cool gifts for anyone on your list.

Whether you’re shopping for a family member, a friend, or a colleague, here’s why you should consider going down the antiques and vintage road this Christmas - with recommendations for 11 Cool Christmas Gifts for Everyone from the experts at Antiques.co.uk: where the past makes a great present.

Nine Antique & Vintage Christmas gift ideas for your wife and mum

As Christmas approaches once more, at the forefront of our minds is what to buy for the women in our lives this year.

It's often difficult to know where to start when buying Christmas gifts for women. That’s why we’re here to help, with our top antique and vintage Christmas gift ideas for your wife, or your mum – or even that special sister in your life.

Best Christmas Gifts for Your Dad or Husband: Antique & Vintage

With just over one month to go until Christmas Day, ‘tis the season to really start thinking seriously about what to give your family and friends this year.

We’re tackling one of the hardest groups to buy for in this article: the man (or men) in your life!

Why Antique and Vintage Makes the Best Christmas Gifts

If you’ve ever stared at a holiday shopping list and felt completely uninspired, you’re not alone.

Finding Christmas gifts that feel thoughtful (and not like you panic-bought them on Christmas Eve) is tough. That’s why this Christmas, we’re making a case for something a little different: antiques and vintage items.

That’s right: pre-loved treasures, one-of-a-kind finds, and objects with stories built right into their DNA.

Antique and vintage items can make some of the best Christmas gifts you can give. We’re here to tell you why the past makes a great present.

Step-by-step guide: how to make easy money in time for Christmas

A step-by-step guide to selling your unwanted antiques and vintage items to thousands of people who are searching for the best Christmas gifts - and make some easy money in time for Christmas.

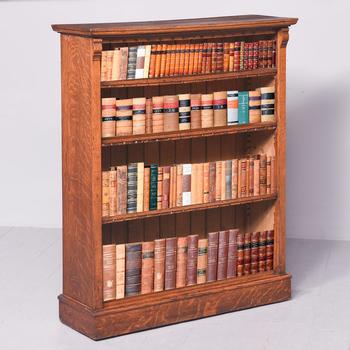

The many reasons to love antique 17th Century English furniture

In today’s modern era of furniture – constructed cheaply with plywood, chip board and MDF – there is something to be said for well-made antique furniture.

Antiques.co.uk’s founder, Iain Brunt, shares his thoughts on why he is a champion of furniture that was built to last: antique 17th century oak furniture.

A Brief History of Time: Antique Grandfather Clocks

You may remember them simply from visiting elder relatives’ houses, or even stately homes. After all, they are the embodiment of the term, ‘antique’, in many people’s minds. But have you ever stopped to wonder how we ended up with our beloved ‘grandfather’ clocks? And the surprising reason why we call them ‘grandfather’?

Find answers to these, as we chart the rise and fall of grandfather clocks.

Important update for sellers: taking art or cultural property in the EU

An important update for antiques dealers and sellers in the UK regarding taking art or cultural property into the EU after 28 June 2025. Here's what you need to know.

Antiques for your Edwardian Summer Garden Party inspiration

Summer is finally here…nearly. And with it comes everything the Great British garden party has to offer: drinks on the terrace, flowers, sunshine (hopefully), all served with a touch of class.

If there was one thing that the Edwardians did well, it was gardens. It was during the 1900s and 1910s that Gertrude Jekyll was prolific in her garden designs, favouring irises and all manner of blousy flowers. Architects like Sir Edwin Lutyens were also hard at work, designing orangeries and formal gardens all over the UK.

So today we’re looking at antiques for your summer garden party inspiration - mostly featuring Edwardian pieces, but some from other eras too.

Flowers in antiques: why our lives would be dull without them

Chelsea Flower Show is nearly upon us, so what better time to take a look at the relationship between antiques and flowers?

Antiques.co.uk Founder Iain Brunt explores why flowers have been an integral part of many styles of antique design throughout the ages – and why life would be so much less fun without them.

7 Antique and Vintage finds to get your garden ready for summer

Our expert inspiration to help you get your garden summer-ready with these seven different types of antique and vintage pieces.

The History of Antique Collecting

With news that two historic City of London markets seem destined to close forever – after over 800 years of continual trading – the antiques market continues to flourish, both online and in our towns and villages.

But unlike the meat and fish of Smithfield and Billingsgate, with antiques you’ll find that every item has a story – and every corner of an antiques shop hides a potential treasure. There’s always a thrill in the search, no matter what you're looking for.

As we pondered the closure of these historically significant London markets, and read up about their history, it got us thinking: how did antique collecting start – and how long has it been going on for?

Important update for antique dealers: extension of the Ivory Act 2018

The Centre for International Trade has shared key updates about the extension of species to the Ivory Act 2018 – one of the toughest bans on ivory sales in the world – which applies to all antique dealers.

Urgent request for all dealers: do you have any of these antiques you could sell?

A large interior designer is looking for these specific types of antique furniture pieces. Here's how to get your items in front of them.

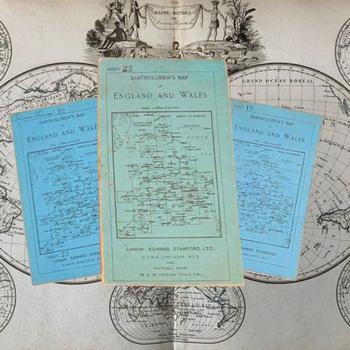

Why collect antique maps? The alternative to GPS and SatNav

There is a much more organic way of getting around with our phones, Google Maps, GPS or car satnav.

Antiques.co.uk's founder, Iain Brunt, explores the upside to collecting antique maps, and how, like record players or writing letters, maps can help us connect more organically to the real world.

The most INCREDIBLE antique finds ever made

January is a fantastic time for clearing out old items from storage. Maybe you have paintings sitting in your attic, or old ceramic pots in the garden which you've never liked?

Many people just want to get rid of what they consider to be old junk - it ends up at thrift stores or charity shops, where just occasionally, the buyer finds out that it's worth a fortune!

Here are the top five most incredible antique discoveries ever made (and how you can make some money from your unwanted antiques).

.jpg)